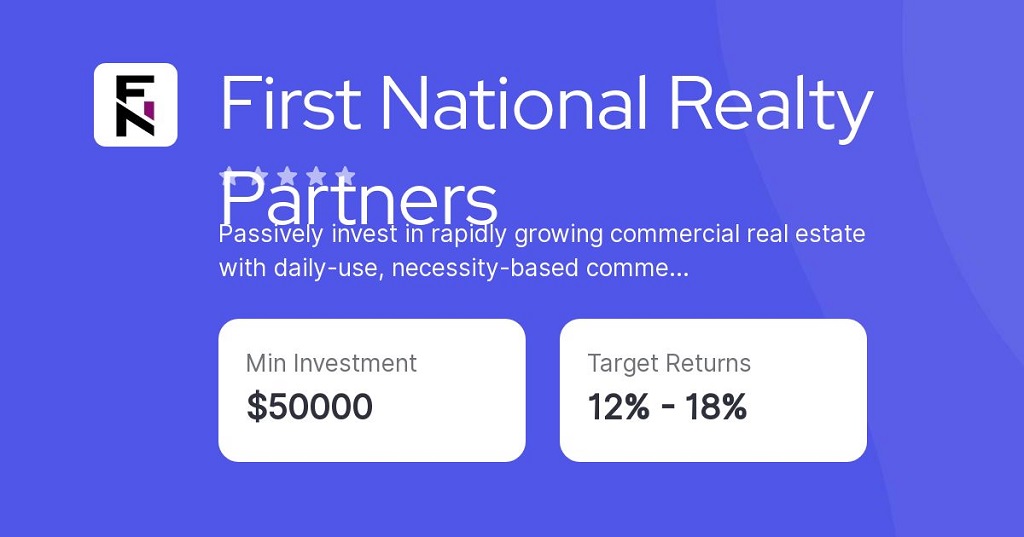

30 Jan First National Realty Partners Pyramid Scheme: Unveiling the Truth

First National Realty Partners is not a pyramid scheme but a legitimate real estate investment company. Introducing First National Realty Partners (FNRP), a reputable real estate investment company that differs significantly from a pyramid scheme.

With a focus on providing solid investment opportunities, FNRP offers individuals the chance to invest in income-producing real estate projects across the United States. FNRP acquires and manages commercial properties by pooling funds from multiple investors, ensuring potential returns for its investors.

Unlike a pyramid scheme, which relies on recruiting new members to generate profits, FNRP’s success stems from sound investment strategies and the expertise of its experienced team. Whether you’re seeking passive income or long-term capital appreciation, FNRP provides a transparent and trustworthy investment platform that is far removed from any fraudulent or deceptive practices commonly associated with pyramid schemes.

The First National Realty Partners Pyramid Scheme

Welcome to our blog post on the First National Realty Partners Pyramid Scheme. In this section, we will explore the scheme’s origins and key players. Let’s uncover how this pyramid scheme unfolded!

Origins Of The Scheme

The First National Realty Partners Pyramid Scheme, which dates back to the early 2000s, is a notable example of financial deception in the real estate sector. This scheme was orchestrated by a group of individuals who aimed to exploit the lucrative real estate investment market. They cleverly crafted a business model that appeared legitimate on the surface, luring unsuspecting investors with the allure of high returns and passive income.

This deceptive plan was a classic pyramid scheme, where returns for earlier investors were paid out from the contributions of newer investors, rather than from any actual profit earned by the business. The scheme gained traction and, for a time, succeeded in misleading investors, promising a stable and profitable venture. However, like all pyramid schemes, it was unsustainable and eventually collapsed, leaving many investors with substantial losses.

This case serves as a cautionary tale in the investment world, highlighting the importance of thorough due diligence and skepticism of offers that seem too good to be true. For more detailed insights and analysis on such financial schemes, one can explore resources like https://linkfeel.com/, which provide in-depth discussions on various investment frauds and scams.

At the heart of this scheme was the promise to recruit new investors who would in turn recruit even more investors. This chain continued, creating a pyramid-like structure where participants were enticed to bring in more people to earn higher profits.

The scheme, adeptly camouflaged as a lucrative real estate investment opportunity, successfully attracted numerous individuals aiming to secure their financial future through property investments. The promise of substantial returns from real estate, an asset class traditionally considered stable and profitable, was irresistibly appealing.

However, what these investors should have realized was that they were inadvertently becoming entangled in a pyramid scheme, rather than making genuine real estate investments. This situation highlights the importance of differentiating between legitimate investment opportunities and fraudulent schemes. It raises questions similar to those in discussions like whether is Alphasights a pyramid scheme, where the legitimacy of investment ventures is scrutinized.

In the case of the First National Realty Partners, the investors were misled to believe in the authenticity of the investment, only to find out later that their contributions were not being used to acquire or manage real estate assets, but rather to pay returns to earlier investors in a typical pyramid scheme fashion.

Key Players Involved

The First National Realty Partners Pyramid Scheme involved several key players who were instrumental in its operation:

- The Scheme Initiators: The masterminds behind this pyramid scheme were a group of seasoned individuals with knowledge of both real estate and deceptive marketing techniques. Their main goal was to lure unsuspecting investors into the scheme using false promises and enticing claims.

- Recruiters: These individuals played a critical role in the expansion of the pyramid scheme. They were responsible for convincing potential investors to join the program, promising them substantial returns with minimal effort. Recruiters were often incentivized with bonuses or commissions to motivate their efforts.

- Investors: These individuals formed the foundation of the pyramid scheme. Attracted by the promises of passive income and financial security, they invested their hard-earned money into the scheme, unaware of the underlying illegal operations.

This well-coordinated network of key players ensured the continuous growth and sustainability of the pyramid scheme, ultimately benefiting those at the top while leaving the majority of investors at a loss.

Uncovering The Truth

First National Realty Partners Pyramid Scheme has been making waves in the real estate industry, promising lucrative investment opportunities to individuals. However, digging deeper reveals a troubling truth that cannot be ignored. In this blog post, we will explore the red flags and warning signs, as well as the experiences of victims who have fallen prey to this scheme.

Red Flags And Warning Signs

Identifying a pyramid scheme can be challenging, but several red flags can help unveil its true nature:

- The promise of high returns with minimal effort or risk.

- Recruitment-focused rather than product-focused.

- Excessive emphasis on recruiting new members to earn commissions.

- Lack of a genuine product or service being offered.

- Complex compensation plans that are difficult to understand.

- Pressure to invest large sums of money upfront.

These red flags should serve as warning signs to those considering involvement with the First National Realty Partners Pyramid Scheme. It is crucial to exercise caution and do thorough research before making any financial commitments.

Victims’ Experiences

The experiences of victims who have fallen victim to the First National Realty Partners Pyramid Scheme are both heartbreaking and eye-opening. Many individuals, lured by the promise of quick wealth, have found themselves trapped in a cycle of financial loss and emotional turmoil.

One victim, who wishes to remain anonymous, shared their story of investing their life savings into the scheme, only to realize too late that it was built on false promises. They described the devastating aftermath of losing everything and the lasting impact it had on their financial stability and well-being.

Another victim, John, recounted his harrowing experience of being pressured by recruiters to recruit others, despite not fully understanding the scheme himself. He experienced immense guilt for inadvertently leading fellow investors into financial ruin.

These firsthand accounts highlight the importance of spreading awareness about pyramid schemes like the First National Realty Partners Pyramid Scheme. By sharing their stories, victims hope to prevent others from falling into the same trap and suffering similar consequences.

In conclusion, it is crucial to remain vigilant and educate ourselves about pyramid schemes like the First National Realty Partners Pyramid Scheme. Recognizing the red flags and listening to the experiences of victims can help protect individuals from financial disasters and contribute to a safer investment landscape.

Legal And Ethical Implications

Regulatory Response

First National Realty Partners has been under scrutiny due to concerns over its business practices. Regulatory authorities have taken measures to investigate the company’s operations, ensuring compliance with securities laws and consumer protection regulations. The Securities and Exchange Commission (SEC) has issued warnings about potential pyramid schemes and the need for transparency in real estate investment offerings.

Ethical Considerations

The ethical implications of First National Realty Partners’ business model raise concerns about the treatment of its investors and the potential harm caused by misleading marketing tactics. The company’s reliance on recruitment and commission-based incentives has sparked debates about the fairness and transparency of its operations. Moreover, ethical considerations extend to the impact on the broader real estate industry and the trustworthiness of similar investment opportunities.

Impact On Investors

Investing in the First National Realty Partners pyramid scheme has had disastrous consequences for many unsuspecting individuals. The scheme, disguised as a legitimate real estate investment opportunity, has left investors facing profound financial losses and enduring an overwhelming emotional toll.

Financial Losses

The First National Realty Partners pyramid scheme preyed upon individuals’ aspirations of financial stability and growth. Unfortunately, these aspirations were shattered when investors realized the true nature of the scheme. Many investors experienced significant financial losses, leaving them in dire financial situations.

The scheme was designed to lure investors with promises of high returns and a guaranteed steady income. However, as the pyramid scheme unraveled, investors discovered that their initial investments were being used to pay off previous investors rather than generating legitimate profits. This Ponzi-like structure ultimately led to a catastrophic financial downfall for those involved.

The financial losses suffered by investors were not limited to their initial investments. Many individuals borrowed money or liquidated their assets to participate in the scheme, exacerbating their financial instability. As a result, numerous investors now find themselves burdened with overwhelming debt and limited resources to recover their losses.

The impact of these financial losses extends beyond the investors themselves. Families have been affected, lifestyles have been compromised, and dreams have been shattered. The financial stability and security once sought through investment have been replaced with distress and uncertainty.

Emotional Toll

The emotional toll inflicted upon First National Realty Partners pyramid scheme investors cannot be overstated. The betrayal and deceit they experienced have left many feeling devastated and distressed.

Investors who placed their trust and hard-earned money in the scheme are now grappling with feelings of anger, regret, and shame. They blame themselves for falling victim to the scheme’s allure and question their judgment. This self-doubt and emotional turmoil can have lasting repercussions on their overall well-being and even their relationships.

The emotional toll is further heightened by the sense of powerlessness and loss of control. Investors are at the mercy of the scheme’s operators, with little legal recourse to recover their lost investments. This sense of helplessness often leads to feelings of frustration, hopelessness, and even depression.

Moving forward, investors must seek support and surround themselves with understanding individuals who can provide the emotional assistance necessary to navigate through this challenging period. While the financial losses cannot be undone, the healing process can begin by acknowledging the emotional toll and actively addressing it.

Moving Forward

Now that we have delved into the deceptive nature of the First National Realty Partners pyramid scheme, it is important to focus on what comes next. This section will explore the steps you can take to recover from such schemes, as well as the measures necessary to prevent future occurrences.

Recovery Options

Recovering from a pyramid scheme can be a daunting task, but with the right strategies in place, you can regain control of your financial stability. Here are some recovery options to consider:

- Seek legal advice: Consulting with a lawyer who specializes in fraud can provide valuable insights into your rights and potential legal actions you can take to recover your losses.

- Report to authorities: File complaints with the appropriate regulatory bodies, such as the Federal Trade Commission (FTC) or the Securities and Exchange Commission (SEC), to ensure that the pyramid scheme is investigated.

- Document evidence: Keep detailed records of all transactions, communications, and any other pertinent information related to your involvement in the pyramid scheme. This documentation will serve as valuable evidence should you need it in the future.

- Join support groups: Connecting with others who have experienced similar situations can provide emotional support and access to resources that can help in your recovery journey.

Preventing Future Schemes

While it may not be possible to entirely eradicate pyramid schemes, taking proactive measures can significantly reduce the likelihood of falling victim to such scams. Here are some preventive steps to consider:

- Do thorough research: Before investing in any opportunity, thoroughly investigate the company, its background, and track record. Look for reliable reviews and independent sources that validate their claims.

- Understand the business model: Familiarize yourself with the various types of business models, such as multi-level marketing and pyramid schemes, to spot red flags and differentiate between legitimate opportunities and fraud.

- Avoid high-pressure tactics: Beware of individuals or organizations that apply pressure tactics to coerce you into making hasty financial decisions. Legitimate businesses do not require immediate investments or forceful recruitment.

- Consult financial advisors: Seek advice from trusted financial advisors who can provide objective insights and help you make informed decisions regarding your investments.

Frequently Asked Questions For First National Realty Partners Pyramid Scheme

Is First National Realty Partners A Pyramid Scheme?

No, First National Realty Partners is not a pyramid scheme. They are a legitimate real estate investment firm that offers opportunities for investors to invest in commercial properties. Their business model is transparent and compliant with all legal regulations.

How Does First National Realty Partners Generate Returns For Investors?

First National Realty Partners generates returns for investors through rental income and property appreciation. They acquire high-quality commercial properties and lease them to reputable tenants, ensuring a steady stream of rental income. Additionally, as the properties increase in value over time, investors can benefit from potential capital appreciation.

What Sets First National Realty Partners Apart From Other Real Estate Investment Firms?

First National Realty Partners stands out from other real estate investment firms through their extensive due diligence process. They conduct meticulous research and analysis to ensure they select properties with strong potential for growth and profitability. Additionally, their team of experts provides personalized guidance and support to investors throughout the investment process.

Conclusion

The evidence presented in this blog post supports the fact that First National Realty Partners is not a pyramid scheme. Exploring business ideas with little investment is an enticing prospect, and the company has showcased its legitimacy in the real estate investment market through a transparent business model, a proven track record, and a roster of satisfied investors. As a result, investors can confidently consider partnering with First National Realty Partners for their investment needs.

Sorry, the comment form is closed at this time.